Savings Tracker Printable – 51 Cute & Free Templates

This post may contain affiliate links, which means I’ll receive a commission if you purchase through my links, at no extra cost to you. Please read full disclosure for more information.

What’s better than a one cute & free savings tracker printable? 51 pretty templates!

Keeping track of your savings and visualizing your

With a savings tracker printable, you can watch your savings grow and stay committed to your goals for your financial future.

Whether you want to start saving for a vacation, an emergency fund, fun things, or a large purchase, having a tangible record of your savings account helps maintain motivation. It gives you a clear picture of where your money is going.

Here, you can find money trackers for every style and preference, from minimalistic designs to cute and fun options.

Just scroll down until you see your favorite design and the download link for the PDF is below each image.

Are you ready to start tracking your savings? Super!

Disclaimer: The content provided is for informational purposes only and should not be considered financial advice. Consult a financial professional for personalized guidance on budgeting and managing your finances.

51 Free printable savings trackers

Here are 51 free printable savings trackers to help you reach your financial goals.

All free printables ©SaturdayGift Ltd. For personal use only, not to be copied, distributed, altered, or sold.

Paper size: US letter, but some are resizable (to A4 page size and other sizes)

Mason jar savings tracker printable

These savings jar printables feature a mason jar image to fill your savings.

DOWNLOAD: Cute Mason Jar Savings Trackers

DOWNLOAD: Mason Jar Savings Log Printable – 2 Designs

Basic printable savings plan with progress bar

DOWNLOAD: Savings Plan Printable- Pretty Pastel

Simple free printable savings tracker

This minimalist tracker lets you track the amount saved and the remaining balance.

DOWNLOAD: Simple Free Printable Savings Tracker

Blank printable savings log

DOWNLOAD: Blank Printable Savings Tracker

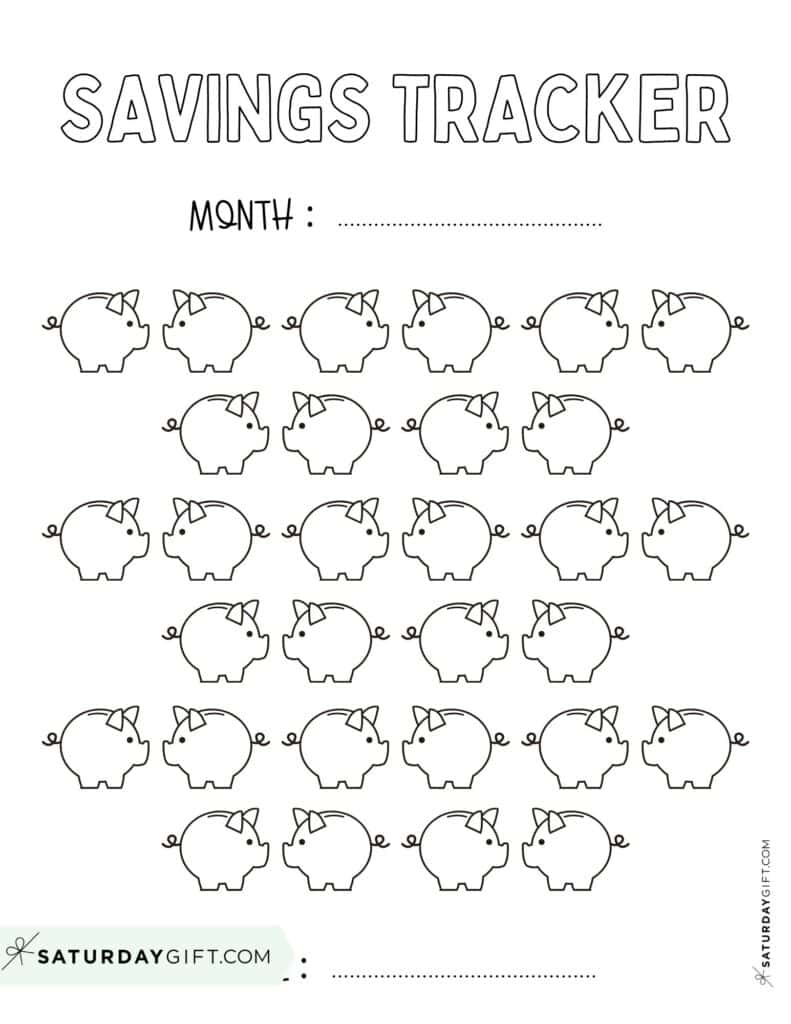

Piggy bank savings tracker

A cute piggy bank design to track your

DOWNLOAD: Piggy Bank Savings Trackers – 2 Designs

Vacation fund tracker

This tracker is perfect for saving up for that dream vacation. It has cute icons to color.

DOWNLOAD: Vacation Fund Savings Trackers – 6 cute colors

DOWNLOAD: Free Printable Vacation Savings Tracker (B&W)

Savings thermometer tracker

This tracker has a fun thermometer design to color in as you reach different savings milestones.

DOWNLOAD: Savings Thermometer Goal Tracker

Savings tracker coloring pages

These mandala coloring pages are also savings trackers.

Decide how much each petal is in savings. And color one part every time you save that much money.

DOWNLOAD: Savings Tracker Coloring Page – 2 Designs

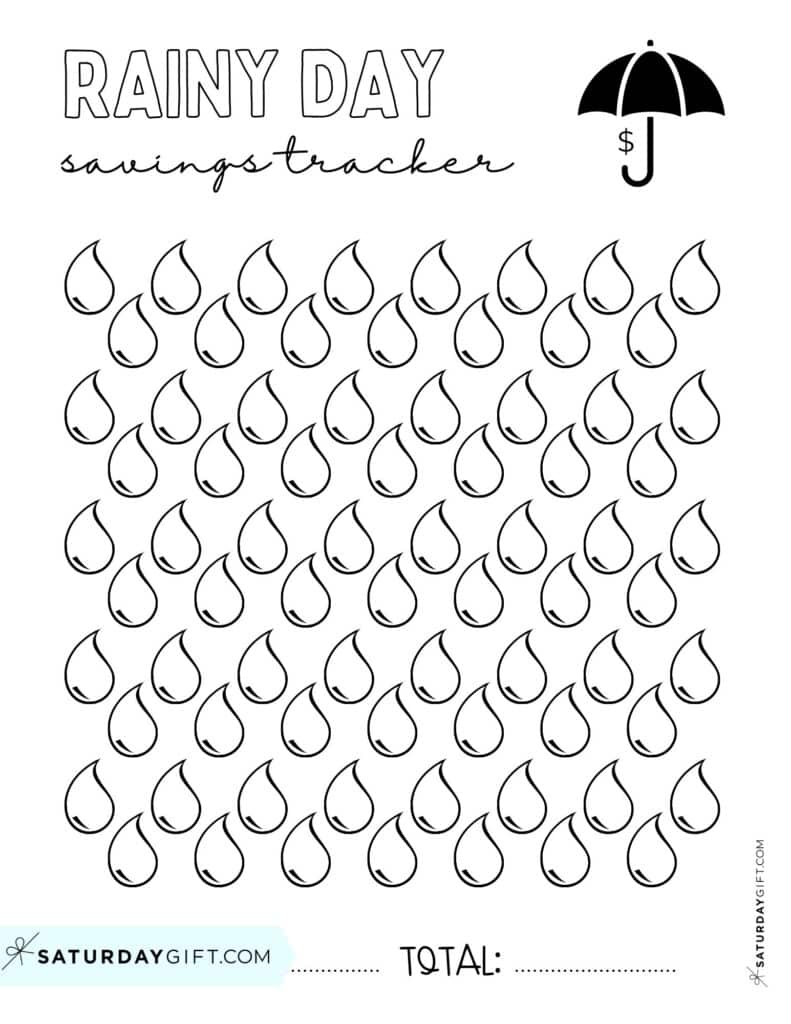

Rainy day – savings tracker

Life can be unpredictable, so having a rainy day fund is essential.

Use this template to track your savings and be prepared for unplanned expenses.

DOWNLOAD: Rainy Day Savings Trackers – 6 cute colors

DOWNLOAD: Free Printable Rainy Day Savings Tracker (B&W)

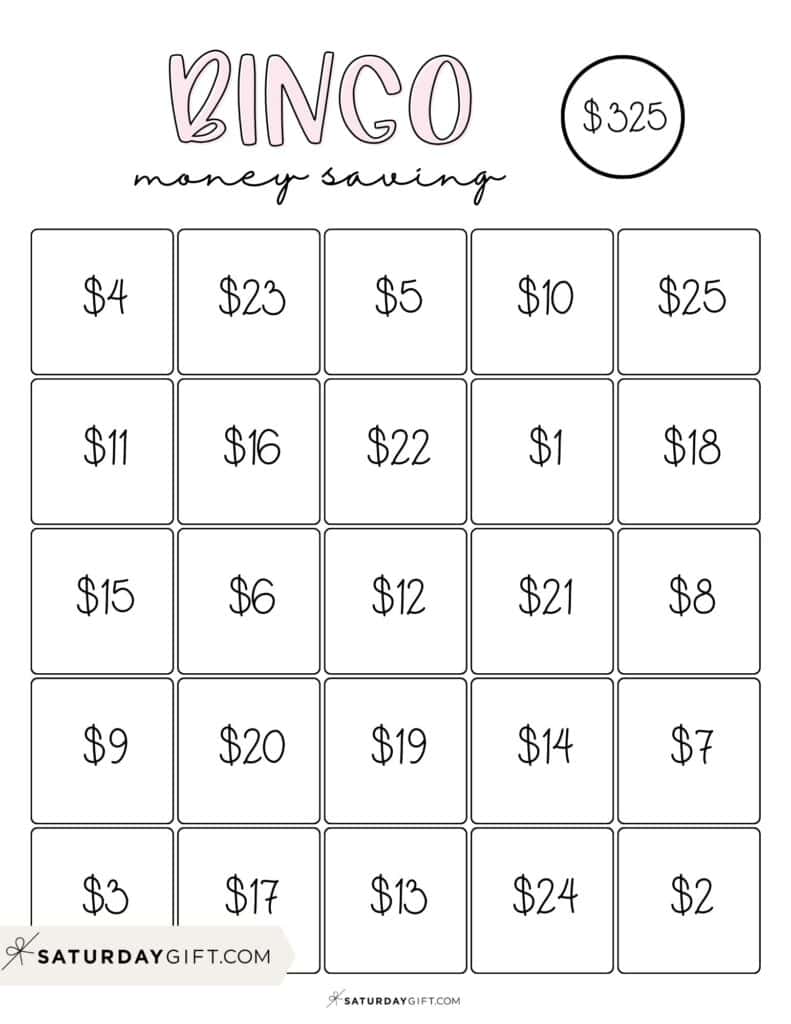

Savings bingo tracker

This tracker is a fun way to save. You’ll save a total of $325, and each day (or how often you decide to save money), you’ll save between $1 and $25.

DOWNLOAD: Bingo Savings Challenge Printable

DOWNLOAD: Blank Bingo Savings Tracker

Alternatively, you can cut squares and place them in a jar. Then, pick up one square each day or week and put the amount in savings.

Monthly savings tracker

This template allows you to follow up on your monthly savings plan and compare it to previous months.

DOWNLOAD: Printable Monthly Savings Tracker

Savings goals tracker

Write down your target savings goals and track

DOWNLOAD: Savings Goals Tracker – Cute Pastel Colors

DOWNLOAD: Savings Goals Tracker – Black & White

Yearly savings tracker template

Set a yearly goal and track your

DOWNLOAD: 52 Week Savings Log – Yearly Tracker

DOWNLOAD: Yearly Savings Tracker Template – Black & White

Free printable house savings tracker

Saving for a house can seem daunting, but with this printable template, you can break it down into manageable chunks and track your

DOWNLOAD: House Savings Tracker – 6 Cute Colors

DOWNLOAD: Free Printable House Savings Tracker (B&W)

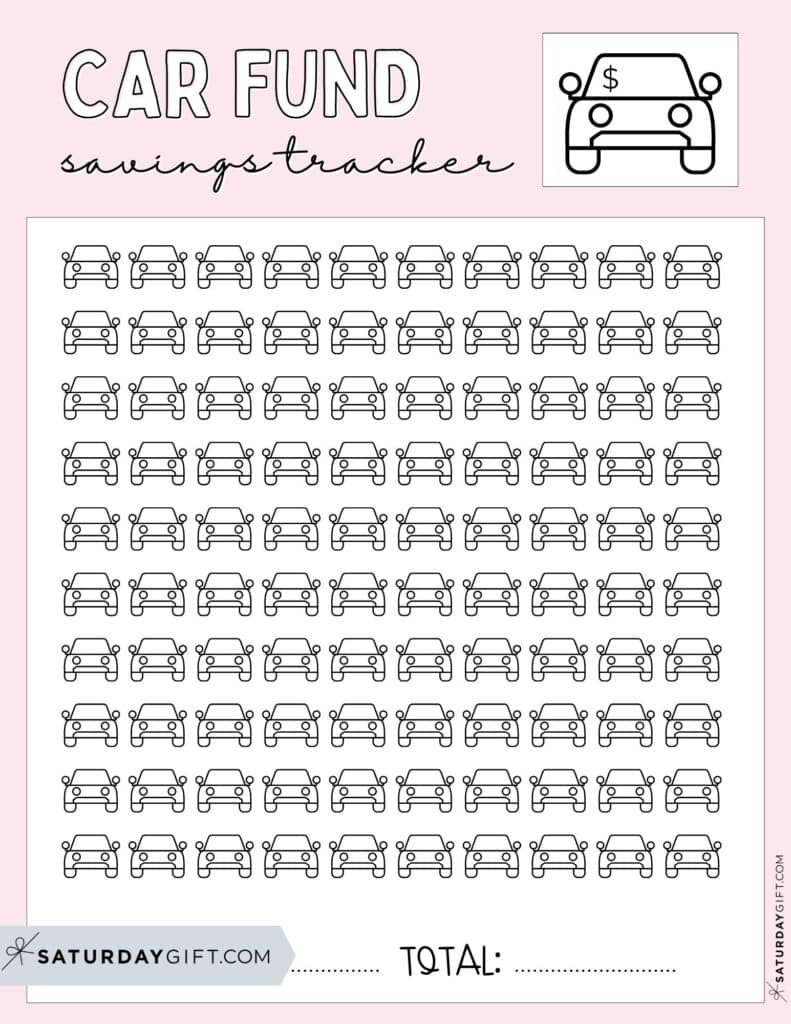

Car saving tracker

Whether you’re saving for a new car or want a fund for future repairs and maintenance, this money-saving chart will help you stay on top of your car savings.

DOWNLOAD: Car Fund Savings Trackers – 6 cute colors

DOWNLOAD: Free Printable Car Savings Tracker (B&W)

52-week savings challenge tracker

A popular challenge where you save a certain amount each week, this tracker helps you stay on track. This is a blank tracker so you can choose the amounts you save.

DOWNLOAD: 52 Week Savings Challenge Tracker (Blank)

Christmas savings tracker

This template is perfect for those who want to save up for holiday expenses.

DOWNLOAD: Christmas Fund Savings Trackers – 3 cute colors

DOWNLOAD: Free Printable Christmas Savings Tracker (B&W)

Emergency fund tracker

Keep track of your emergency savings with this simple yet effective printable.

Check out post: Emergency Fund (IN THE MAKING – COMING SOON)

Credit card debt payoff tracker

Use this tracker to keep track of your debt payoff

Check out post: Debt Trackers (IN THE MAKING – COMING SOON)

Psst! You can combine these designs with the other cute & free finance planners and trackers to create a money management binder.

How to use a savings tracker

Using a savings tracker is simple and easy.

- Choose the printable that best fits your needs and preferences.

- Write down your starting balance and goal amount.

- Each time you save money, write the amount or color in or mark off the corresponding amount on the tracker.

- Update your

progress regularly to help you stay motivated and on track. - Once you reach your goal, celebrate and set a new one!

Why use a savings tracker?

- Visual representation of

progress : With a savings tracker, you can see exactly how much you have saved and how close you are to reaching your goal. It can be highly motivating and encourage you to keep saving. - Accountability: By keeping a record of your savings, you are holding yourself accountable for your financial goals and can see where your money is going.

- Stay on track: A savings tracker gives you a clear overview of your

progress and can help you focus on reaching your goal. - Track patterns: By using a savings tracker regularly, you may notice patterns in your spending and saving habits, allowing you to make adjustments as needed.

- Celebrate achievements: Reaching a savings goal is an accomplishment worth celebrating! With a savings tracker, you can see your

progress and feel proud of your achievements.

How to save more money

Creating a habit of saving money is an essential step towards financial freedom. Here are a few ways of doing that:

1. Know your money

The first step to saving more money is knowing where your money is going.

Make a list of all your expenses. Categorize or divide them into needs (must-haves) and wants (nice-to-haves).

Make a budget. Consider using a printable budget planner to keep track of your expenses.

If you don’t know exactly where your money is going, finding areas where you can cut back and save can be difficult.

RELATED POST: 200+ Budgeting Categories + Budget Categories List PDF

2. Set realistic savings goals

Setting achievable goals is essential when it comes to saving money. Goals mustn’t be so challenging that they’ll paralyze you or too easy that you won’t feel motivated to achieve them.

Set SMART (specific, measurable, attainable, relevant, and time-bound) goals for your savings.

For example, instead of saying, “I want to save money,” you can set a goal of saving $500 for your emergency fund in the next three months.

3. Create a savings account

The easiest way to save money is to put it in a separate account.

This way, you won’t be tempted to spend it and will see your savings grow even faster!

4. Automate your savings

One easy way to save more money is to automate it.

Set up automatic transfers from your checking account to your savings account regularly (e.g., every time you get paid).

This way, you won’t have to manually transfer the money and risk forgetting about it.

5. Cut back on unnecessary expenses

Look for areas where you can cut back on your spending.

For example, do you need that daily latte, or could you make coffee at home instead? Are you paying for subscriptions you don’t use?

Small changes in your spending habits can add to significant savings over time.

POST: Ways to save money – IN THE MAKING – COMING SOON

Setting your savings goals

The first step before tracking is to define your savings goal.

Are you putting money aside for a vacation, a down payment on a house, or building an emergency fund?

Establishing clear savings goals will make the process more focused and meaningful.

Short-term vs. long-term goals

Money saving can be categorized into short-term and long-term goals.

Short-term goals are usually achievable within a year, such as saving for a vacation or buying a new laptop.

However, long-term goals, such as saving for a house payment or retirement, take more time to achieve and require consistent savings over several years.

Short-term goals

These are what you’re planning to achieve within a year or so. Examples include:

- Vacation savings

- Emergency fund

- Purchasing a new gadget

Creating short-term goals allows you to see quick

Use a table to help organize these goals.

| Goal Type | Example | Target Amount | Time Frame | Savings/ Month |

|---|---|---|---|---|

| Vacation Savings | Trip to Hawaii | $3,000 | 6 months | $500 |

| Emergency Fund | Medical expenses | $1,000 | 3 months | $200 |

| New Gadget | New smartphone | $800 | 5 months | $160 |

Long-term goals

These typically take multiple years to achieve and would include:

- Saving for a house down payment

- New car

- Retirement fund

Long-term goals require a more patient and sustained approach. Breaking these goals into smaller milestones can make them more manageable and less daunting.

Calculating your savings targets

Calculating your savings targets is vital for setting actionable and realistic goals. Here’s a simple way to start:

- Identify the total amount needed for your goal.

- Set a deadline by when you’d like to reach it.

- Divide the total amount by the number of months until your deadline.

Here is an example of a new car:

- Total Saving Goal: $20,000

- Deadline: 4 years (48 months)

- Monthly Savings Target: $20,000 / 48 = $416.67 per month

For financial goals with a high degree of importance, like an emergency fund, start with whatever amount you can regularly commit to and build from there.

Whether you’re seeking short-term indulgences or long-term stability, setting savings goals and understanding how to calculate your targets is crucial to financial success.

Use a savings tracker printable to help keep your goals in sight and your

Incorporating trackers into budget planning

Aligning your savings goals with your monthly expenses is crucial to successfully managing your budget.

Start by listing your regular expenses in one column and projected savings in another.

Use a budget planner to categorize and track your monthly spending on f.ex rent, groceries, utilities, personal care, and entertainment.

It can help you spot areas to cut back and increase your savings capacity.

Conclusion

With these 51 cute savings trackers, you’ll have no trouble staying on top of your financial goals.

Choose the design that works best for you, and start tracking your savings today!

Remember, every little bit counts towards a better financial future.

Happy saving!