Cute (& Free!) College Budget Templates + Tips

This post may contain affiliate links, which means I’ll receive a commission if you purchase through my links, at no extra cost to you. Please read full disclosure for more information.

Ready to start budgeting for college? This guide & free college budget template will help you prepare a monthly budget tailored to your needs as a college student.

Disclaimer: The content provided is for informational purposes only and should not be considered financial advice. Consult a financial professional for personalized guidance on budgeting and managing your finances.

College student budget template

These pretty & practical budget templates will help you keep track of your expenses and income so you can make informed financial decisions throughout your college journey.

Paper size: US letter, but some are resizable (to A4 page size and other sizes)

All free printables ©SaturdayGift Ltd. For personal use only, not to be copied, distributed, altered, or sold.

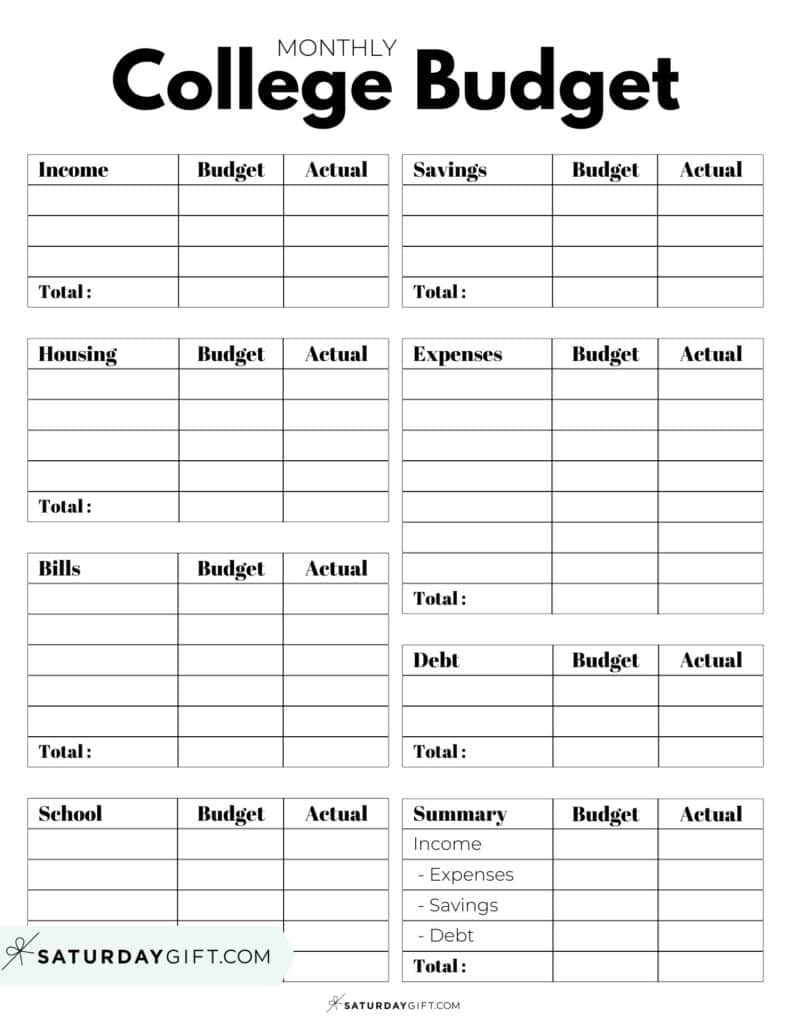

Blank college budget template – free printables

Psst! You can combine these designs with the other cute & free finance planners and trackers to create a money management binder.

How to use the college budget template

Each row in the college student budget worksheet has two columns – budget and actual.

- In the budget column, you’ll enter the amount of money you plan to spend for each category.

- In the actual column, you’ll enter the actual amount spent.

Comparing those two amounts will help you track your spending and see where to make adjustments.

And here are the things to budget and track:

Income

- Scholarships and grants

- Student loans

- Work income

Monthly Expenses

- Housing (rent, utilities, internet, etc.)

- Bills (Phone, transportation, insurance, subscriptions, etc.)

- Expenses: (Groceries, dining out, clothing, personal care, entertainment, etc.)

- School: (Tuition fees, books, supplies, etc.)

Savings

- Emergency fund

- Sinking funds

- Savings for future expenses (study abroad, internships, etc.)

Debt payments

- Credit card debt

- Student loans

Summary

Here, you write down your income, expenses, savings, and debt payment totals.

The formula is simple:

Total Income – Total Expenses – Total Savings – Total Debt Payments = Net Income

- If you have a positive net income, you have money left over after covering all your expenses. This means you made more money than you spent. This can be used for additional savings or as discretionary spending.

- If you have a negative net income, you spend more than you make. This is a sign that adjustments need to be made in your budget to avoid accumulating debt.

Creating Your college student Budget

1. Start by listing all sources of income

Include any money you receive from a job, scholarships, financial aid, or family support.

List all of your expenses, including fixed and variable expenses.

- Fixed expenses are recurring expenses that typically stay the same each month, such as rent and utilities.

- Variable expenses are expenses that can fluctuate each month, like groceries and entertainment.

RELATED POST: Income Tracker Printable – 19 Cute & Free Printable Templates

2. Assign a dollar amount to each expense category

Use past bank statements, credit card statements, or receipts to estimate how much money you typically spend in each category per month.

RELATED POST: 200+ Budgeting Categories + Budget Categories List PDF

3. Include savings & debt payment

Include savings and debt payment categories in your monthly budget. Savings can include, for example, emergency fund, sinking funds, savings account or investments.

RELATED POST: Savings Tracker Printable – 51 Cute & Free Templates

4. Compare your total income to your total expenses

Ideally, your income should be higher than your expenses.

If not, you may need to adjust how you spend money or find ways to increase your income.

5. Keep track of your actual spending

Enter the amount spent in each category on your budget template as the month progresses. This will help you see where you may be overspending or where you can cut back.

RELATED POST: Expense Tracker Printable – 26 cute & Free Spending Logs

6. Adjust your budget as needed

If you notice that you are consistently overspending in a specific category, look for ways to decrease your expenses.

You can also make adjustments to your budget if your income or expenses change throughout the month.

Saving money while in college can be challenging, but having a budget and knowing your spending habits can help you stay on track and reach your financial goals.

Why budgeting is essential for college students

There are multiple benefits in budgeting your money as a college student. Here are a few:

1. Helps you stay on track

College can be a whirlwind of new experiences and temptations, making overspending easy. A budget lets you be accountable and prioritize your spending, ensuring you don’t go overboard with unnecessary expenses.

2. Allows you to save for future goals

By budgeting and tracking your expenses, you can allocate money towards important goals like studying abroad or building an emergency fund. This helps you plan for the future and avoid financial stress.

3. Develops good financial habits

Budgeting teaches discipline and responsibility when managing money. These skills are essential for your financial health and will benefit you long after college.

4. Helps you avoid debt

With the rising cost of education, many students rely on loans to finance their studies. By budgeting and keeping track of expenses, you can avoid overspending and accumulating unnecessary debt.

Tips to save money as a college student

Here are a few tips to save money as a college student.

1. Create a Budget

Start by tracking your income and expenses to create a realistic budget. Knowing where your money is going can help you identify areas where you can cut back and save. Use a printable college budget worksheet or a spreadsheet.

2. Cook at Home

Eating out can quickly drain your wallet. Instead of dining out frequently, cook meals at home and pack lunches for school to save money.

3. Take Advantage of Student Discounts

Many stores, restaurants, and entertainment venues offer student discounts. Always ask if a student discount is available before making a purchase.

4. Buy Used Textbooks

Textbooks can be expensive, but you can save significant money by purchasing used or renting textbooks instead of buying new ones.

5. Use Public Transportation

If you live off-campus or need to commute to school, consider using public transportation instead of owning a car. Public transit passes are often more affordable than the costs associated with owning a vehicle.

6. Limit Impulse Purchases

Before making a purchase, ask yourself if it’s a necessity or a want. Avoid impulse purchases by waiting 24 hours before buying non-essential items to determine if you truly need them.

7. Find Free or Low-Cost Entertainment

Look for free or low-cost entertainment options like campus events, movie nights, or outdoor activities like hiking or biking.

8. Utilize Campus Resources

Take advantage of the resources available on your college campus, such as the library, fitness center, and career services. These amenities are often included in your tuition and can help you save money on external services.

9. Create an emergency fund for unexpected expenses

Set aside some money each month into an emergency fund to help cover unexpected expenses.

10. Use a savings tracker and allocate extra money toward your goals

Setting financial goals and tracking your

In conclusion

Budgeting is an essential skill for college students to learn and practice.

By creating a budget, tracking expenses, and making informed spending decisions, you can save money, avoid debt, and develop good financial habits that will benefit you long after graduation.